April 7, Monday: Stock markets across the globe plunged on Monday, triggering a widespread sell-off reminiscent of past financial crises, as fears of a full-blown U.S. recession, escalating trade wars, and fresh tariff hikes by U.S. President Donald Trump sent shockwaves through global investors.

Asian Markets Lead the Meltdown

The turmoil began in Asia, where markets opened to a sea of red following a sharp downturn on Wall Street last Friday.

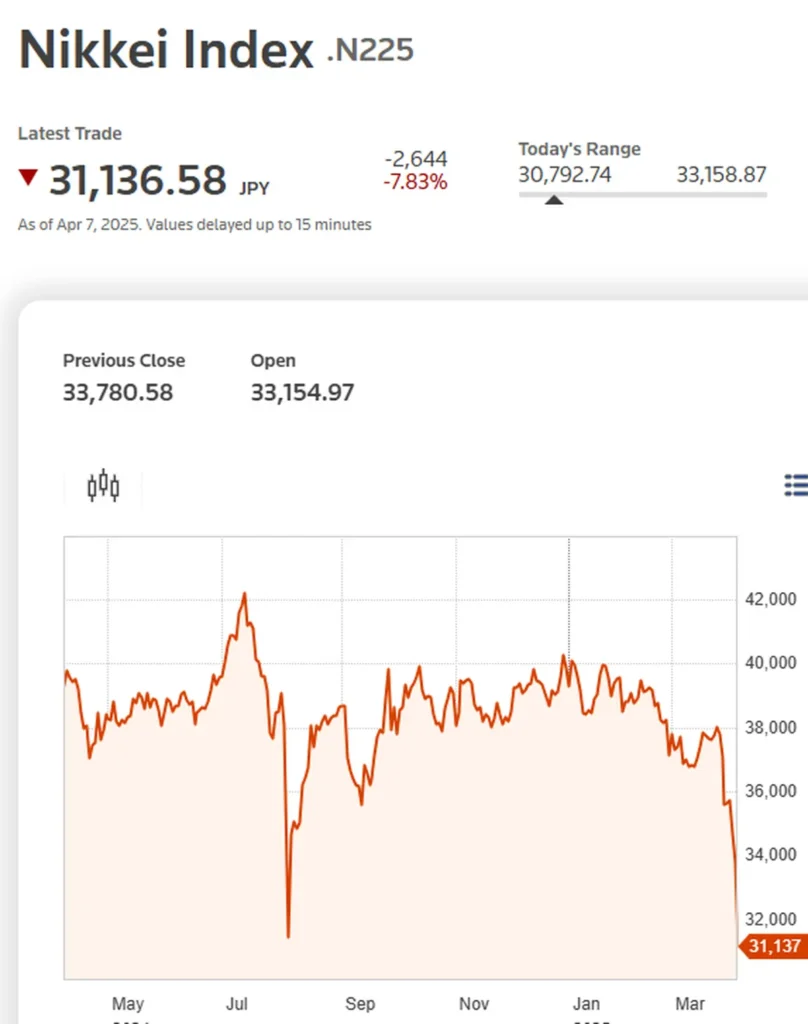

- Tokyo’s Nikkei 225 tumbled nearly 8% soon after trading began.

- Hong Kong’s Hang Seng nosedived almost 11%, marking one of its steepest falls in years.

- Shanghai Composite dropped 6.3%, showing that even mainland China’s markets, which usually move on their own trends, were not immune.

- Taiwan’s Taiex suffered a sharp 9.7% fall, one of the most significant single-day declines in the region.

The panic was not limited to East Asia. Indian benchmark indices also mirrored the global rout. The Sensex plunged by nearly 4%, trading around the ₹72,300 level, while the Nifty 50 slipped below the critical 22,000 mark. The Gift Nifty Futures index was down over 1% around mid-morning, reflecting continued market anxiety.

Tariff Troubles: Japan Pushes Back

Amidst the market carnage, Japan’s Prime Minister Shigeru Ishiba took a proactive stance against the rising protectionism from Washington. Addressing Japan’s parliament, Ishiba announced plans to urgently initiate talks with the U.S. government in a bid to reverse or stall the newly imposed American tariffs on Japanese goods.

“We must make it clear that our country is not engaged in any unfair trade practices,” Ishiba stated firmly.

“I intend to speak directly with President Trump to explain Japan’s position and negotiate the removal of these tariffs.”

This comes after President Trump signaled there would be no immediate rollback of tariffs, a stance that has rattled financial markets worldwide.

Recession Fears Take Center Stage

Beyond trade concerns, economists and analysts are increasingly warning of an impending U.S. economic slowdown or even a recession, further fanning investor fears. Bond markets have shown signs of stress, and investor sentiment has taken a hit as uncertainty looms over monetary policy responses from central banks globally.

India Not Spared

India, while somewhat insulated from direct trade tension with the U.S., is feeling the heat of global investor sentiment turning risk-averse. Sectors sensitive to global demand, such as IT, metals, and banking, have borne the brunt of the sell-off. Broader indices also remain under pressure as foreign institutional investors (FIIs) pull out capital amid the global uncertainty.

What Lies Ahead

As the world awaits further clarity from the U.S. on its trade policies and whether diplomacy can de-escalate tensions, markets are expected to remain volatile. Any sign of compromise or rollback could bring temporary relief, but until then, investor caution is likely to dominate sentiment.

Keep reading questiqa world. Get more News Headlines On Our Social Platforms And Do Follow.